Understanding the U.S. Stock Market: A Roadmap to Investment Success

The Historical Performance of the U.S. Stock Market

The U.S. stock market has shown remarkable growth over the years. It has weathered many storms and come out stronger. From the Great Depression to the 2008 financial crisis, the market has always bounced back.

Over the long term, stocks have outperformed other asset classes. The average annual return of the S&P 500 has been about 10% since its inception. This makes stocks an attractive option for wealth building.

However, it's crucial to remember that past performance doesn't guarantee future results. The market can be unpredictable in the short term. This is why a long-term perspective is often recommended.

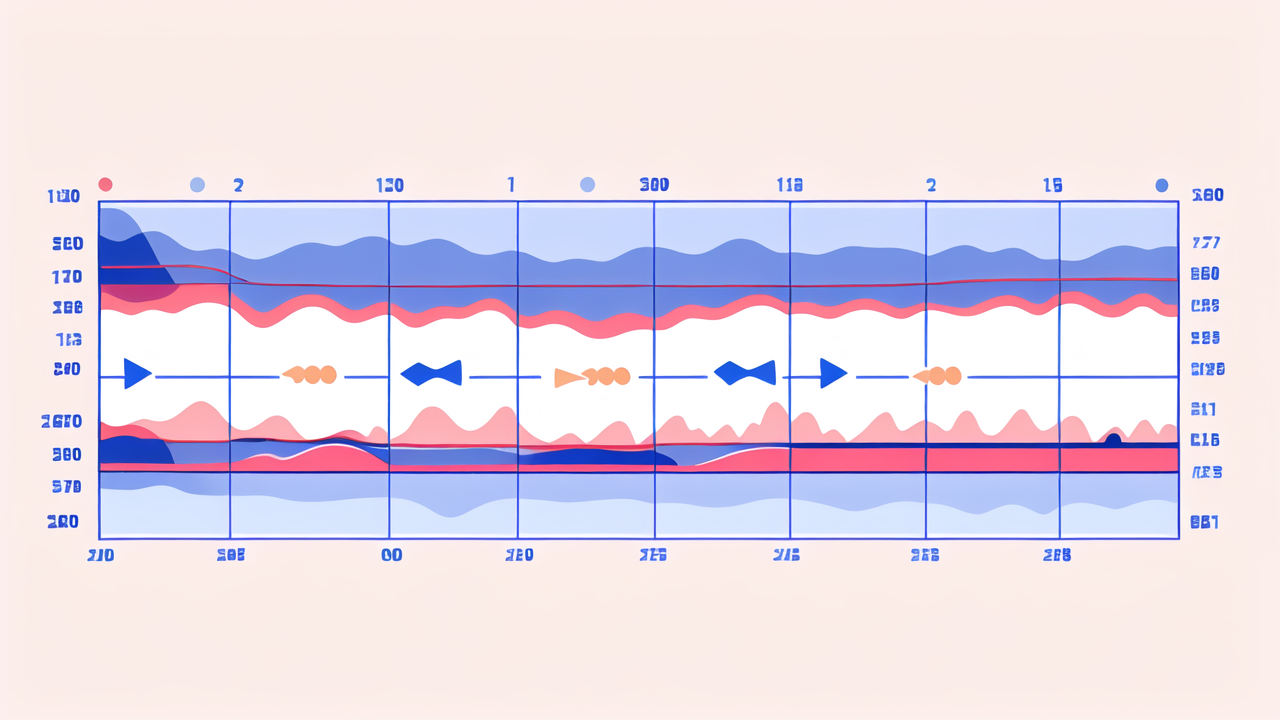

Key Economic Indicators and Market Cycles

Understanding economic indicators is vital for successful investing. These indicators can help predict market trends. Some key indicators include:

- GDP growth rate

- Unemployment rate

- Inflation rate

- Interest rates

- Consumer confidence index

Market cycles are also important to understand. These cycles include:

- Expansion

- Peak

- Contraction

- Trough

Recognizing where we are in a market cycle can inform investment decisions. It can help investors time their entry and exit points more effectively.

Navigating Market Volatility: Strategies and Tips

Market volatility is a normal part of investing. It can be unsettling, but it also presents opportunities. Here are some strategies to navigate volatile markets:

- Stay calm and avoid panic selling

- Maintain a diversified portfolio

- Consider dollar-cost averaging

- Keep a long-term perspective

- Have an emergency fund to avoid forced selling

Remember, volatility often creates buying opportunities. When others are fearful, it may be time to be greedy, as Warren Buffett famously said.

Building Wealth through the Stock Market: Expert Strategies

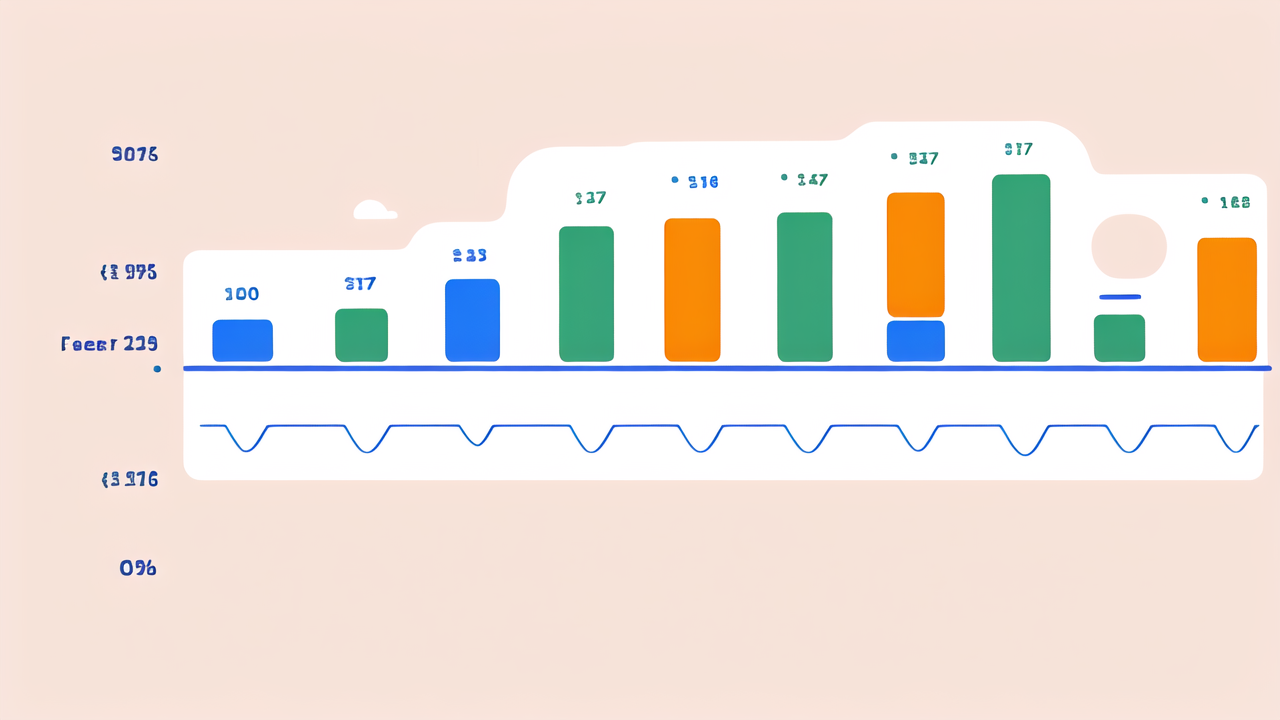

The Role of Diversification in Portfolio Building

Diversification is a key principle in investing. It helps manage risk by spreading investments across different assets. A well-diversified portfolio might include:

- Stocks from various sectors

- Bonds

- Real estate investments

- International stocks

- Commodities

The goal is to create a mix that aligns with your risk tolerance and financial goals. Diversification doesn't guarantee profits, but it can help reduce potential losses.

Timing the Market: When to Buy and Sell

Timing the market perfectly is nearly impossible. Even experts struggle with this. However, there are strategies that can help:

- Buy when valuations are low

- Sell when you need the money or your goals change

- Rebalance your portfolio regularly

- Use dollar-cost averaging to reduce timing risk

Remember, it's time in the market, not timing the market, that often leads to success. Consistent, long-term investing tends to yield better results than trying to time market highs and lows.

Long-Term Planning: Setting Realistic Financial Goals

Setting clear, realistic financial goals is crucial for successful investing. Your goals will guide your investment strategy. Consider factors like:

- Your age and time horizon

- Risk tolerance

- Income needs

- Future expenses (education, retirement, etc.)

Be specific about your goals. Instead of "save for retirement," aim for "save $1 million by age 65." This makes your goals measurable and achievable.

Review and adjust your goals regularly. Life changes, and your financial plan should adapt accordingly.

Leveraging Trends for Optimal Growth

Identifying Emerging Industries and Market Trends

Spotting emerging trends can lead to significant investment opportunities. Some current trends include:

- Artificial Intelligence and Machine Learning

- Renewable Energy

- E-commerce and Digital Transformation

- Biotechnology and Healthcare Innovation

To identify trends, consider:

- Reading industry reports and financial news

- Following thought leaders in various sectors

- Analyzing consumer behavior changes

- Monitoring technological advancements

Remember, not all trends turn into profitable investments. Do thorough research before investing in any trend.

How to Adapt to Regulatory Changes Impacting the Stock Market

Regulatory changes can significantly impact the stock market. Stay informed about:

- Changes in tax laws

- New industry regulations

- International trade policies

- Environmental regulations

Adapting to these changes might involve:

- Adjusting your portfolio allocation

- Exploring new investment opportunities

- Reconsidering certain investments that may be negatively impacted

Always consult with a financial advisor to understand how regulatory changes might affect your investments.

The Importance of Staying Informed on Market Developments

Staying informed is crucial for successful investing. It helps you make better decisions and adapt to changes. Here are some ways to stay informed:

- Read financial news regularly

- Follow reputable financial websites and blogs

- Attend investment seminars or webinars

- Join investment clubs or forums

- Use financial apps for real-time updates

However, be careful not to get overwhelmed by information. Focus on reliable sources and information relevant to your investment strategy.

Remember, the key to successful investing is a combination of knowledge, patience, and discipline. Stay informed, but avoid making rash decisions based on short-term market movements.